Are you a commercial property owner in Westchester, the Bronx, Manhattan, or Connecticut looking to optimize your real estate investments?

Understanding commercial real estate management fees is crucial for maximizing your property’s Net Operating Income (NOI) and ensuring efficient building operations. At CurCo Properties, we specialize in providing transparent, value-driven property management services tailored to the unique needs of closely held commercial properties in the New York Tri-State area.

In this comprehensive guide, we’ll break down the various types of commercial real estate management fees, explore the factors that influence these costs, and provide insights on how to negotiate the best terms for your property. Whether you’re managing apartments, retail spaces, or office buildings, our local expertise will help you navigate the complexities of property management in Westchester County and beyond.

| Fee Type | Typical Range | Influencing Factors |

|---|---|---|

| Base Management Fee | 3% – 6% of rent | Property size, location, complexity |

| Leasing Fee | 4% – 8% of lease value | Market conditions, lease terms |

| Construction Management | 2% – 5% of project cost | Scope of work, project duration |

| Accounting/Reporting | $500 – $2,000/month | Property portfolio size, reporting frequency |

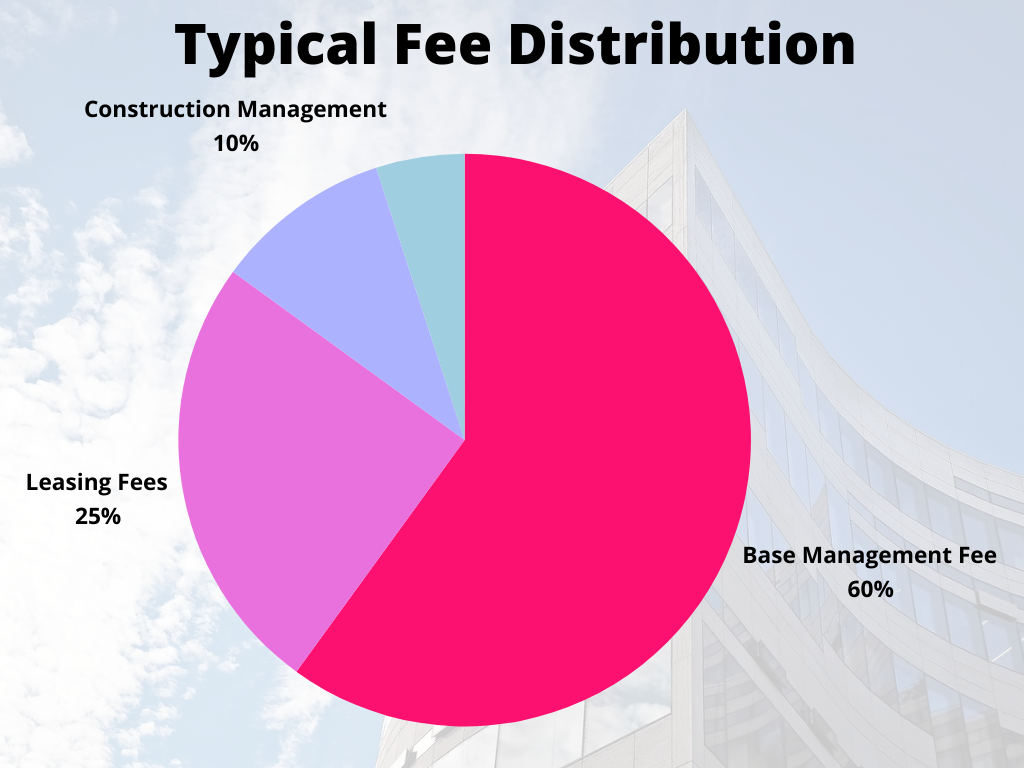

Types of Commercial Real Estate Management Fees

When you’re budgeting for property management, it’s crucial to look beyond just the base fee. There are often additional costs to consider. For instance, you’ll still need to pay for property repairs and maintenance. If your building needs new tenants, there might be advertising costs. And sometimes, you might need legal help, like if you have to evict a problematic tenant.

Base Management Fee

This is the main fee you pay for day-to-day management of your property. It usually covers things like collecting rent, dealing with tenants, and making sure the building is well-maintained. Most companies charge between 3% to 6% of the rent they collect for you.

Leasing Fees

When your property manager finds a new tenant for your building, they might charge a leasing fee. This is usually a percentage of how much the tenant will pay in rent over their whole lease. It can be anywhere from 4% to 8% of the total lease value.

Construction Management Fees

If your property needs big repairs or renovations, your manager might charge extra to oversee this work. This fee is often 2% to 5% of how much the whole project costs.

Accounting and Reporting Fees

Some companies charge extra for keeping track of your property’s money and giving you reports about how it’s doing. This can cost between $500 to $2,000 per month, depending on how big your property is and how often you want reports.

At CurCo Properties, we understand that one size doesn’t fit all when it comes to fee structures. The most common approach is charging a percentage of the rent collected. This aligns our interests with yours – the more rent we collect, the more we both earn.

Some companies prefer a flat monthly fee, regardless of how much rent comes in. Others use a hybrid model, combining a lower percentage with a small flat fee. There’s also a growing trend towards performance-based fees, where the management company gets a bonus for exceeding certain goals, like keeping occupancy high or reducing expenses.

What Makes Management Fees Go Up or Down?

Now, you might be wondering why these fees can vary so much. Well, several factors come into play. Several things can change how much you pay for property management:

- How Big and Complicated Your Property Is Bigger buildings or properties with lots of different parts (like a mix of stores and offices) usually cost more to manage.

- Where Your Property Is Located Properties in busy city areas like Manhattan might cost more to manage than those in quieter places like some parts of Connecticut.

- What Kind of Property You Have Different types of properties (like apartments, stores, or offices) might have different management costs.

- What Services You Need If you want your manager to do more things, like marketing your property or handling all repairs, you’ll probably pay more.

- How the Real Estate Market is Doing When the market is really good and it’s easy to find tenants, fees might go up. When it’s harder to rent out spaces, fees might go down.

Why Professional Management Matters

Even with the associated costs, professional property management can be a smart investment. At CurCo, we bring deep knowledge of local laws and regulations, saving you the headache of keeping up with changing rules. We handle tenant issues promptly, keeping your renters happy and your property occupied. Our maintenance programs can help prevent small problems from becoming big, expensive ones.

Moreover, our expertise in the New York Tri-State area means we understand the unique challenges and opportunities of managing properties in Westchester, the Bronx, Manhattan, and Connecticut. We can help you navigate local market trends and maximize your property’s potential.

Choosing the Right Management Company

When you’re looking for a property management company, experience and local knowledge are key. Ask about their track record with properties similar to yours. Make sure they’re familiar with your specific area – managing a property in downtown Manhattan is quite different from managing one in suburban Westchester.

Transparency is also crucial. A good management company should be upfront about all their fees and what services they include. Don’t hesitate to ask for references from other property owners they work with.

At CurCo Properties, we pride ourselves on our clear communication, local expertise, and commitment to our clients’ success. We understand that your commercial property is a valuable investment, and our goal is to help you make the most of it.

Understanding commercial real estate management fees is an important part of being a successful property owner. While these fees are a necessary expense, they can also be an investment in the long-term success and profitability of your property. With the right management partner, you can navigate the complexities of commercial real estate and achieve your investment goals.